Fintech core

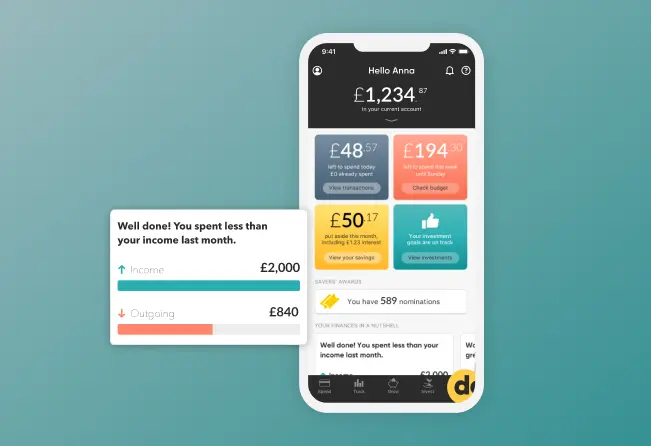

White label modular fintech solution for creation & fast launch of digital banking and payment products as an apps or on the web Book Demo

core features

Benefits of DashDevs core

banking solution

Fintech core allows you to launch your product in weeks instead of months. You can use it in any region and language.

Our solution is complaint with all standard regulators. So you can easily certify your final solution if needed.

You don’t have to develop core banking and standard fintech modules from scratch.

Fintech core build on the most modern technologies. Your solution would be able to grow and expand.

you will get with

fintech core

Solid foundation for

fintech products

neobank

To remain competitive, a neobank needs to have fine tailored online banking software. It includes a back-office system, accounts, funds exchange, payments, acquiring, open banking and card issuing. With the help of our banking platform software you’ll build the most convenient neobank for your customers.

digital wallet

Our cloud banking software allows additional benefits such as bitcoin, insurance cards, plane and concert tickets, coupons, gift cards, IDs and driver's licenses to encourage customers to use their services in addition to debit and credit cards. Book a core banking software demo to see how it may look for your digital wallet.

money transfer

With our cloud based core banking solutions, you’ll integrate existing systems and create your own. Provide international transfers so your clients can send money to any country using only one app interface. With our cloud core banking solution, you’ll enable QR codes, magic links, and NFC-based P2P transactions.

marketplace payment

We tailor our fintech software solutions to the specific needs of each of our clients. In addition to providing fully customizable payment structure, alternative delivery options, and user flows. Our solution gives access to a wide range of application programming interfaces (APIs).

mobile wallet

Users can store their cash in a secure mobile wallet with our custom banking software solution. It is suitable for storing a wide range of digital assets including cryptocurrencies, credit and debit cards, gift cards, airline tickets and loyalty cards. Book a fintech core banking system demo to see how it works.

payment acceptance

With our fintech white label solution your customers could make secure and convenient payments using QR codes, e-wallets and electronic bank transfers. We enable your customers to make instant online payments through our digital asset trading platform solution.

general ledger

We create modern fintech system design so your product isn’t held back by outdated technology. To ensure that the infrastructure is as modern as your product, our fintech architecture offers a general ledger platform. As a result, you have better visibility and control over the account and transaction information.

Other fintech products

Increase the range of your products with our fintech white label software. Your product roadmap can include more opportunities due to the adaptability of Fintech Core to unique structures, i.e. crypto exchange software solutions and other fintech products.

Fintech Core banking software

solutions for

Innovative & unique software solutions, that customary tailored for your business needs

fintech startups

Control your operations more effectively, boost your client service, and remain in compliance with industry requirements.

retail banks

Expand your product arsenal with electronic bill integration and payment options with core banking system.

Multiple challenges

One core banking software

The banking sector is experiencing an increasing level of competition. Therefore, new generation banks using core banking software are gaining market share by occupying lucrative niches in the value chain, forcing incumbent banks to re-evaluate their outdated methods. Our core banking platform will help you prepare your product for true open banking by facilitating a future-proof microservices architecture and reducing development time.

- pci & dss

compliant

Our solution is ready for PCI & DSS compliance

- Turn key

solution

Source code based modular fintech solution

- Multi

platform

iOS and Android applications, Web application

- fast

to launch

1,5 months till launch ready to use fintech solution

- Multi cultural interface

Culturally adaptive user interface, multi-regional & language support

- adaptive &

scalable solution

Customisation for specific business needs & custom development

Request Fintech Core Demo

- pci & dss

compliant

Our solution is ready for PCI & DSS compliance

- Turn key

solution

Source code based modular fintech solution

- Multi

platform

iOS and Android applications, Web application

- fast

to launch

1,5 months till launch ready to use fintech solution

- Multi cultural interface

Culturally adaptive user interface, multi-regional & language support

- adaptive &

scalable solution

Customisation for specific business needs & custom development